Processing Credit Card Transactions The Right Way

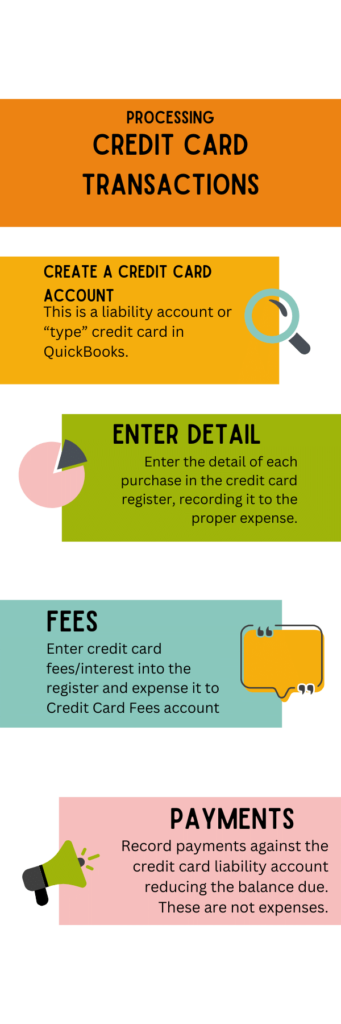

Set Up The Account in Chart of Accounts

It’s important to process credit card transactions correctly so your books are in good order and you have the details essential to sound business decisions and correct tax deductions. In your accounting system set up a credit card account in your chart of accounts for your business credit card or if you are a sole proprietor and use a personal card, I would suggest you select one that will be used strictly for business and then set up an account the same way in your chart of accounts. A credit card is a liability account when created and in QuickBooks it will be a “type” credit card.

Record Each Transaction

As you make purchases using the card enter the expenses into the credit card register (like a bank register, the credit card account also has a register in your accounting system. You should enter each individual transactions into the register expensing it according to the type of expense it is and according to the rules that govern business deductions. Meals should always go to a meals expense account, mainly because expenses of this type are not 100% deductions on taxes and as such must have their own category. Make sure to detail each expense as its made during the statement period until all transactions have been recorded. You can set up your accounting system to download transactions as they are made but you will still need to ensure the expense settings for each.

Record Any Credit Card Fees

The fees charged by your credit card company each month if the balance is not paid in full should also be recorded in the register and I suggest setting up an expense called Credit Card Fees and recording same there. Although these are at times called finance charge or even interest charges these are separate from loan or mortgage type fees and should be kept separate. Keeping it separate will also help you see what the convenience is costing you from month to month. Sometimes those costs can be a real eye opener.

Record The Payment

When a payment is made on the credit card the payment should be directed against the liability / type credit card account that was set up. This payment itself is not expensed but instead serves to reduce the overall credit card balance due. Paying it in full each month is the best practice.

Reconcile – Wrapping it up!

Each month when the statement comes out this account should be reconciled to the ending statement balance as should all checking, credit card and loan accounts be.